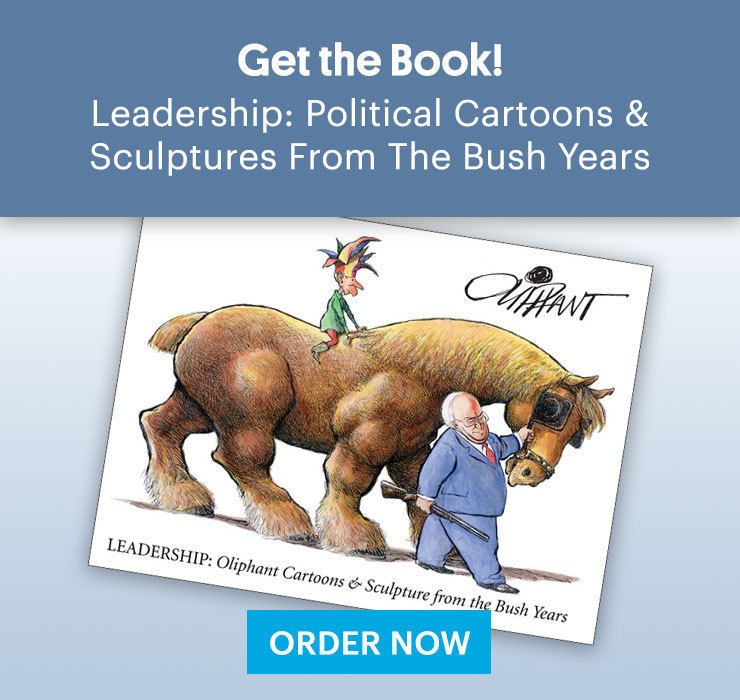

Pat Oliphant for October 27, 2008

Transcript:

Alan Greenspan: I was against regulation, yes, but I had no idea those greedy Wall Street pigs would behave like greedy Wall Street pigs! I was shocked! Shocked! George W. Bush: Who's in the cart? Man: Alan Greenspan, who caused the mess we're in - and who might you be? Punk: He's just waiting his turn in the cart!

bell3rose1a over 15 years ago

It’s too good for him!

MaryWorth Premium Member over 15 years ago

It was the best of times, it was the worst of times…

Simon_Jester over 15 years ago

Next up is Phil Graham, McCain’s economic guru.

Motivemagus over 15 years ago

Simon - it’s Phil Gramm. Strangely, both like and unlike the cracker!

dhleaky over 15 years ago

Oliphant is a genius.

Eugeno over 15 years ago

Unfortunately, more than one person is responsible for the problem - and, also unfortunately, none of them have any responsibility to ‘the people’ -the Federal Reserve is completely independent of the gov’t, with NO oversight of any kind.

Alexus_The_Great over 15 years ago

poor Mr. Greenspan, who would ever think that radical capitalists will behave as radical capitalists with no regulation? what about the trickle down economics? what about the “natural” distribution of wealth when you give humongous tax cuts for the rich? what COULD have happened with those beautiful fairy tales?

GNWachs over 15 years ago

Of course the people who bought a $600,000 home with a gross income of $60,000 were just duped. And Clinton forcing the banks to make sub-prime loans was just bad luck. Far better to blame the other guys.

jimbo90036 over 15 years ago

Why was Greenspan surprised!

HUMPHRIES over 15 years ago

GNW, your line has been running on endless loop for weeks now. Do try another approach.

Alexus_The_Great over 15 years ago

GNW: Let me ask you ONE question: Did the wanna-be home owners put a gun in the heads of the financial institutions forcing them to give huge credits to pay for over-priced houses????

Suetonius over 15 years ago

GNWachs Let us try this one more time. Between 92 and 98% of those “unfit” subprime borrowers are making their payments on time with no foreclosure. That is 9 out of 10. THEY are NOT to blame for this crisis. It is the “clever” brokers who came up with the ridiculous idea of pooling and selling debt as a security. Want some background? Go ahead and read about the Great Panic of 1819. In a lot of ways, it seems to be the best parallel to the present situation. Substitute “financial institutions selling CDO’s” for “wildcat banks” and you pretty much have history repeating itself almost 200 years later.

davidlewis over 15 years ago

Subprime loans were a bad thing, but US housing would be just another market bubble that burst if it weren’t for “credit default swaps”, i.e. CDSs, which are actually insurance. They used the word “swaps to avoid insurance industry regulations, with Greenspan’s approval.

Imagine normal insurance. You pay someone a premium, and they pay you if your house burns down. That’s how the “swaps” industry started. Then, because there were no regulations, it evolved so that ten of your neighbors could buy policies from ten different companies so that if your house burned down, ten companies have to pay the full value of your house to ten of your neighbors. Credit default insurance is insurance against someone not paying a loan back, among many other things.

From around 2000 to 2008 $55 - $65 trillion dollars of policies were issued as financial instruments to banks and institutions all over the world. Its just like a load of side bets on a football game by now. This is the biggest casino that has ever existed. Now, when a house burns down, say Lehman Bros bankruptcy, it’s a big “credit event” which makes policies of far greater value than anything on Lehman’s books suddenly become liabilities on the books of banks all over the world. If one of those institutions goes bankrupt as a result, its another “credit event”, and on and on. This is an unprecedented situation. Lehman wasn’t too big to fail, the consequences of letting Lehman fail were too grave to let it fail. There’s a difference. They didn�t understand what would happen if they let Lehman go, they know now and its regarded as the mistake of the century. The CDS industry wanted no regulation so they would not have to keep capital on hand to back up the policies they sold because they allowed themselves to believe there was very little risk as there would never be an impossible situation like US house prices going down and a lot of mortgage backed securities suddenly becoming worthless, otherwise they never would have let the world’s financial institutions become interlocked in this way so that the entire system resembles a bunch of dominoes teetering on the brink. The mortgage backed securities just threaten serious damage, but the rest are so interlocked by CDSs that the entire world is threatened.

People are considering, how could this have been allowed to happen? And the answer is coming up, again and again, from people who understand what happened, that the guy who prominently declared that this stack of dominoes, as it was being built, was lowering risk, was Alan Greenspan.

Celogen over 15 years ago

Will anyone ever pay for this?

Jeffritoman over 15 years ago

“Will anyone ever pay for this?”

We already are.